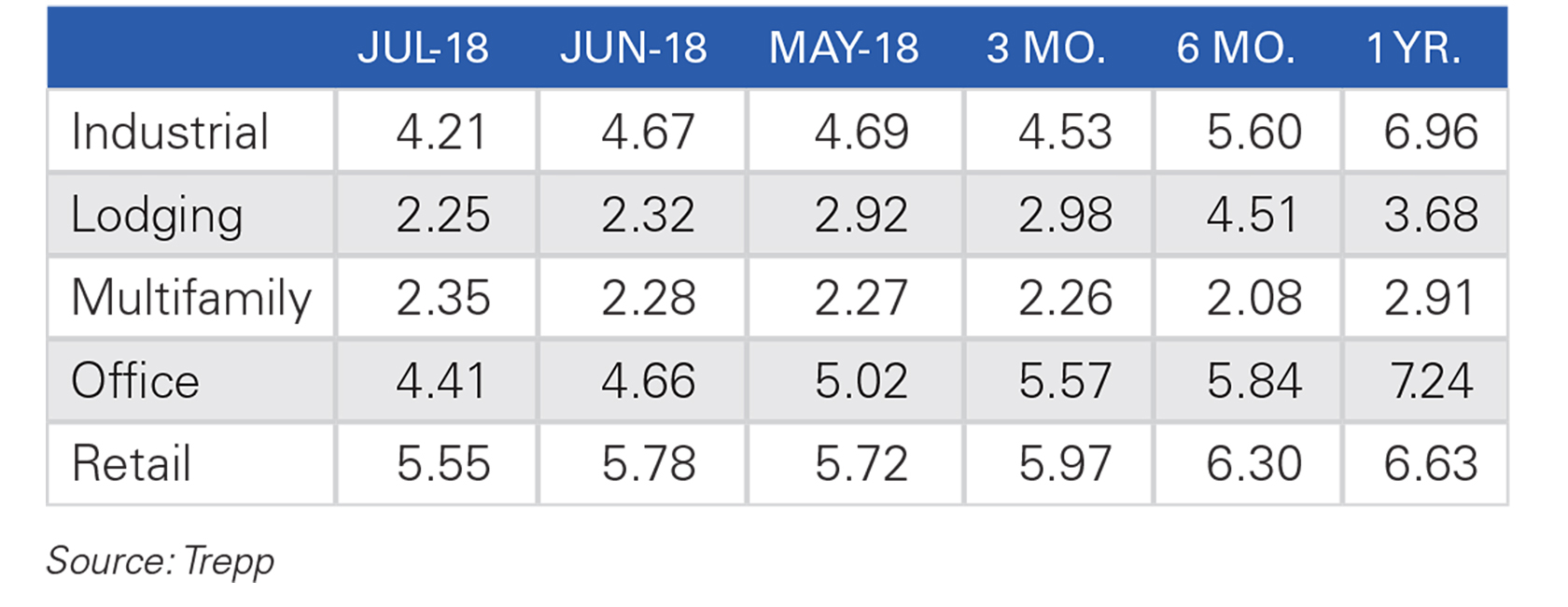

The overall delinquency rate for U.S. commercial-mortgage-backed real estate loans in July is 3.81 percent, down by 14 basis points from June, according to Trepp’s index. The firm says the continued resolution of distressed legacy debt and the brisk pace of new loan securitization caused the rate of loans seriously past due (at least 30 days delinquent) to decline by about 1 percent since the beginning of the year and to set a post-crisis low in July.

Retail commercial-mortgage-backed-securities loans were the weakest type; their delinquency rate in July declined by 23 basis points month on month, to 5.55 percent. By contrast, hotel CMBS loans posted a delinquency rate of 2.25 percent, and multifamily CMBS loans posted a rate of 2.35 percent.

Delinquency rate by property type

By Brannon Boswell

Executive Editor, Commerce + Communities Today