Why Investors Expect to Buy More Commercial Property This Year

The CBRE 2024 Global Investor Intentions Survey of 1,400 investors across the U.S., Europe and Asia-Pacific, conducted in November and December, reveals a shift in sentiment after sluggish investment in 2023. Investors anticipate a rise in purchasing activity this year, driven by:

- distressed property opportunities: Investors are eyeing potentially undervalued assets and nonperforming loans.

- price corrections: Investors believe some property prices have fallen enough to become attractive entry points.

- improved ROI: Expectations are for better overall return on investment in 2024.

However, higher interest rates and mismatched expectations between buyers and sellers are considered significant hurdles. Additionally, stricter lending practices by banks with lower loan-to-value ratios and heightened focuses on borrower solvency are making debt financing more difficult.

Despite these concerns, a significant portion of U.S. investors plan to adopt opportunistic strategies. The survey suggests a potential buying spree for distressed assets and nonperforming loans.

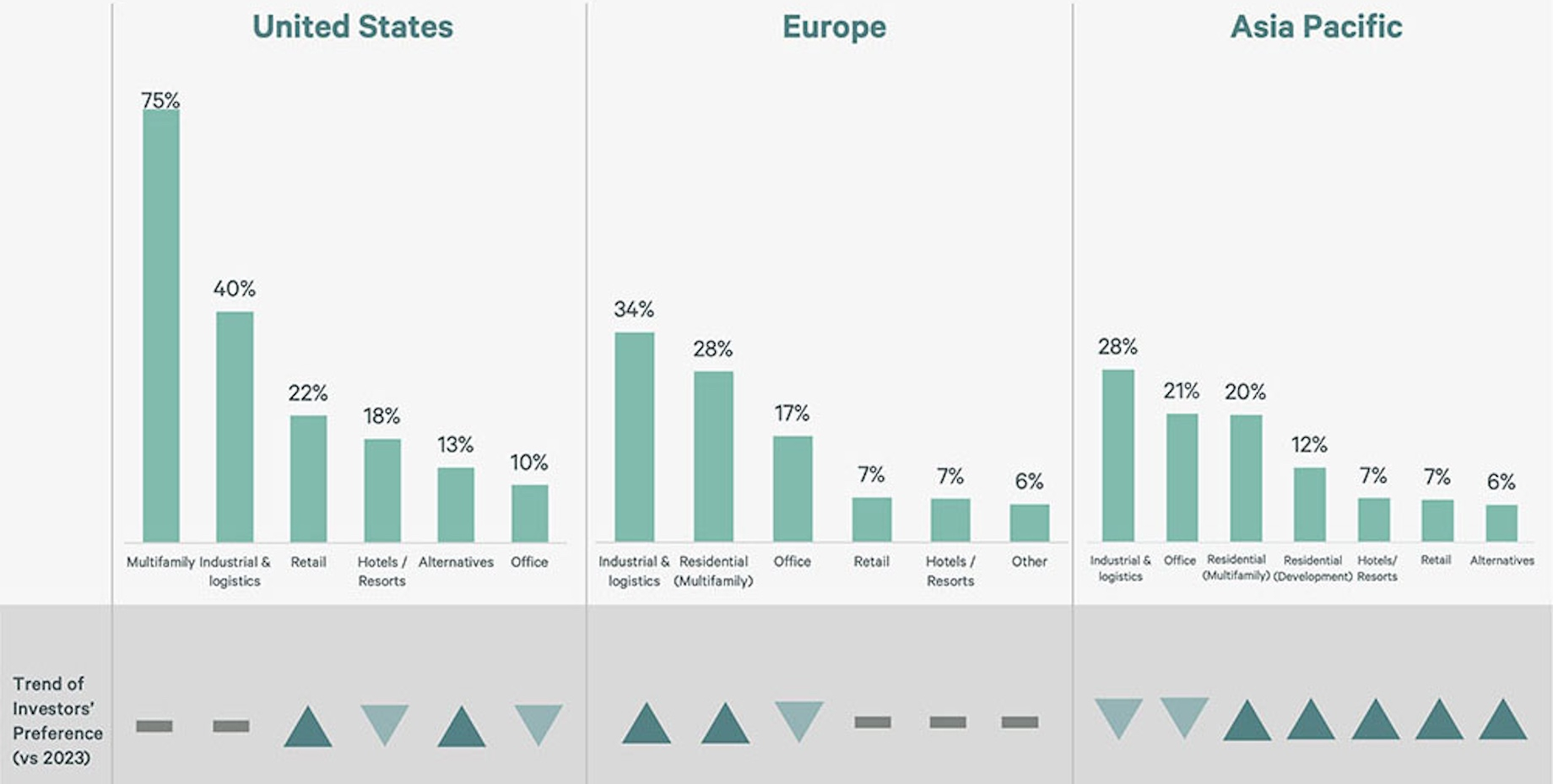

Investors’ Preferred Commercial Real Estate Sector

Source: CBRE 2024 Global Investor Intentions Survey

Overall, the commercial property market is expected to see a modest growth in 2024. CBRE predicts a 5% year-over-year increase in total investment volume in the U.S. after a substantial 45% drop last year. The pace of activity will hinge on fluctuations in the 10-year Treasury yield, which is expected to stay high through the first half of the year, according to CBRE.

Regency Centers Tests Short-Term-Leasing Tech

Regency Centers will use the Spacewise software platform to help retailers and brands find and book spaces for short-term lease at 25 of its 482 its properties. The tech is intended to reduce the time it takes landlords to arrange short-term leases via automation and helps them market their properties and space inventory, generate leads and qualify prospects.

The paperwork involved in vetting tenants, negotiating leases, collecting payments and handling renewals limits landlords’ return on investment, according to Spacewise chief customer officer and Americas president Brennan Wilkie. Regency Centers vice president of marketing and communications Jan Hanak said: “We’re always looking to expand our dealmaking capabilities. Short-term leasing provides an opportunity for brands to be first to market. Spacewise’s platform allows new retailers to find our audience and for us to find new brands in an easy-to-use format.”

The arrangement marks the Zurich-based tech company’s entry into the U.S. Among the properties at which Regency has deployed Spacewise are Village at La Floresta in Los Angeles, Mellody Farm in Chicagoland, Woodway Collection in Houston and Oakleaf Commons in Jacksonville, Florida.

Locals Will Crowdfund Chicago Shopping Center

Chicago TREND has arranged four crowdfunded shopping centers in Baltimore, and now, true to its name, the Black-led social enterprise that launched in 2016 to uplift Black communities, has its first property in Chicago. DL3 Realty, whose managing principal Leon Walker grew up in the city’s Roseland neighborhood, sold the 27,000-square-foot Roseland Medical and Retail Center to Chicago TREND for $6 million to advance the cause. As of this morning, the crowdfunding campaign on Small Change has raised $20,500.

Fully occupied by two medical facilities, a drugstore, a Subway restaurant and local tenants, the property sits across the street from Roseland Community Hospital and won a Chicago Neighborhood Development Award for Outstanding For-Profit Neighborhood Real Estate Project in 2009.

Chicago Trend founder Lyneir Richardson spoke in-depth with C+CT last March about his plans to narrow the racial wealth gap via resident ownership of retail properties. His enterprise launched allows residents to invest a minimum of $1,000 and receive a portion of rent revenue in return. Regarding the recent Roseland deal, he told CBS News: “People hopefully will patronize and protect and respect the shopping center in a different way.”

Chicago TREND has seen success in Baltimore, where 330 investors participate at an average investment of $2,275, according to CBS News. Among them, 58% are Black and 42% are women. “They’re church mothers. There’s charter school parents. They’re young professionals,” Richardson told CBS News. “You want people to have an ownership stake as the neighborhood gets stronger.”

The Rundown from ICSC@CAROLINAS

Rising consumer debt, increased labor costs and inflation could stir up challenges despite the industry’s current strong sales, healthy rent growth and high occupancy rates, ICSC president and CEO Tom McGee advised Marketplaces Industry executives at ICSC@CAROLINAS in Charlotte, North Carolina, last week. “We’re going to be fighting inflation for a period of time,” McGee cautioned attendees. He emphasized the importance of monitoring the 10-year Treasury yield. A rapid increase in rates could disrupt the transactions market, he warned.

Despite these headwinds, Edens, a development firm with a fixed-rate-debt balance sheet, is seeking off-market deals to expand its presence in Charleston, South Carolina, according to director of leasing Catherine Bickford. The firm is interested in both redevelopment and ground-up development, particularly in West Ashley, Mount Pleasant and the Peninsula.

During the ICSC@CAROLINAS event’s Retailer Runway, Kids Empire territory manager Reuben Rischall reported that the growing entertainment concept will open 30 to 40 new corporate-owned locations annually. In 60% of its new deals, he said, landlords have been willing to invest to accommodate the 21-foot minimum ceiling height for the concept’s signature climbing attraction.

Woodfield Development highlighted the strong demand — 80% leased — for its Morrison Yard apartments in Charleston. The project’s 22,000-square-foot retail component has attracted Barry’s fitness studio and a local Pilates studio. Negotiations are ongoing with urban grocers and a destination restaurant, according to partner Mike Schwarz. He noted a big difference in the leasing process for retail versus multifamily. “It is absolutely remarkable,” he said. “We have people signing leases on $6,000-a-month apartments in six minutes on the multifamily side, and it takes us six months to get a lease signed on the retail side.”

Swipe-Fee Showdown Ends

Following years of legal battles over swipe fees, Visa and Mastercard have reached a settlement that reduces and caps credit card processing fees for merchants. The settlement will reduce credit interchange rates for U.S. merchants, comprised largely of small businesses, according to Visa. Retailers currently pay an average of 1.5% to 3% per credit card transaction, according to Bankate.

URW Launches U.S. Edition of Westfield Good Festival Highlighting Sustainability

Unibail-Rodamco-Westfield will bring its Westfield Good Festival to 15 U.S. properties this year, following a successful European launch in 2023. The landlord aims to inspire sustainable living by showcasing ecoconscious brands and hosting activities like fashion shows featuring recycled and upcycled clothing, art galleries displaying works made from recycled materials, clothing swaps, musical performances, and educational workshops. Visitors also can donate to local charities, recycle e-waste and learn about sustainable practices from retailers and community organizations.

Cullinan Properties Hires Michael Gold as President

Michael Gold

Cullinan Properties appointed Michael Gold president. Gold most recently served as COO for Pine Tree, where he started as vice president of leasing. His first real estate role was associate at CBRE. Gold is the Membership Chair of the ICSC Illinois Marketplace Council, and he’s a guest lecturer for the real estate programs at DePaul University and University of Wisconsin-Madison. He will be based in Cullinan Properties’ Chicago office.

By Brannon Boswell

Executive Editor, Commerce + Communities Today