Tech startups are setting their sights on the shopping center industry, a shift that has already triggered big changes for some owners, managers and brokers, experts say. Backed by incubators such as Y Combinator or Blackstone, the creators of these platforms aim to attack inefficiency wherever they find it. “Great new companies are coming out of the woodwork to solve problems, and it is just amazing to see,” said Nick Romito, founder and CEO of VTS, which offers a leasing and asset-management tool for retail real estate. “We are past the tipping point. The industry knows it needs technology, and it is not going back.”

At Regency Centers, leasing agents and property managers used to have to climb onto roofs to check the condition of expensive HVAC units. Now they use software from Ravti, a Y Combinator–backed firm, to view images, specs and histories of the equipment. At DDR Corp., tenants are using an online portal called SnapPay RE to transmit rent payments and report sales. DDR, bullish about such emerging solutions, even helped shape the focus of a local startup founded by graduates of Case Western Reserve University. “This group created an online platform that sources requests for proposals, or RFPs, and we helped them understand how it could work at a corporate-level commercial real estate company,” said Kevin Moss, DDR’s chief information officer. “They have now evolved into a growing startup called Scout RFP. We have already rolled this out internally for tenant coordination and construction and are preparing to extend it to the property management side as well.”

Landlords and property managers have used an array of tech tools since at least the late 1990s. Across the industry, however, many basic processes are still in need of an update, according to some proponents of real estate tech. Paying rent is a case in point. While national tenants with hundreds of stores often work with landlords to set up automatic electronic payments, most local retailers continue to rely on traditional methods to pay rent and report sales, says Christa Vesy, DDR’s chief accounting officer. Besides being time-consuming and inefficient, this manual approach carries greater risk of mistakes. Across a large portfolio, even occasional differences can translate into sizable headaches. “We’ve got to match up every single payment with every single tenant charge,” Vesy said, “and we need to do it down to the nickel.”

A growing number of retail landlords are now looking at using online portals to make rent payments and sales reporting more efficient, says Moss. “Making online payments is a big change for retail real estate,” he said. “There is a huge opportunity here.” DDR began testing SnapPay RE (a product of Aurora, Ill.–based CDI Technology) in January 2015. The platform was designed to integrate with Oracle’s JD Edwards EnterpriseOne software, which is used companywide at DDR. “The ability to integrate with JD Edwards was absolutely critical,” Moss said. “It is the main system we use to run our business.” The new portal enables DDR to track tenant billings in real time. Retailers can log on and see how much rent they owe, along with such charges as common-area maintenance fees, real estate taxes, insurance premiums and the like.

“Tenants get to pay exactly what they want, in exactly the time they want, and DDR gets an automated way of bringing it into our system and posting it,” Moss said. As of July, DDR’s local tenants were using the portal to pay a total of about $3 million per month on average. The rollout has seen rapid adoption driven by local tenants, with upwards of 30 percent participation across the overall portfolio, Vesy says. “The game-changer for our retailers really has been the transparency and the level of detail they get from SnapPay,” she said. “They also like that it is easy, efficient and makes their life easier. We continually get that specific feedback from them.”

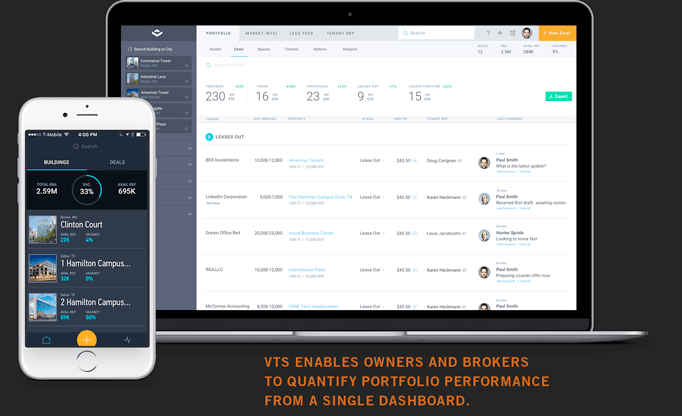

Making life easier was the idea behind the 2012 launch of VTS, which promotes its leasing and asset-management tool as the first product of its kind for retail real estate. The platform enables owners and brokers to track and manage deal activity, identify trends and quantify portfolio performance from a single dashboard. Over the past four years, VTS has raised a record amount of capital for a real estate tech startup — reportedly, about $200 million — from investors such as Blackstone, Insight Venture Partners, OpenView Venture Partners and Trinity Ventures. The New York City–based company employs 155 people across eight offices globally. Among its clients are Boston Properties and TIAA-CREF.

“Eight out of the top 10 largest asset managers now use our platform,” Romito said. Key to this growth is the platform’s ability to put critical data at the fingertips of owners and brokers even as it streamlines formerly manual tasks, he says. “A broker recently told me that before VTS, he would spend anywhere from three to five hours a week just creating Excel reports for his different investors,” Romito said. “In the broker’s world, time is your most valuable asset. You could be spending those hours doing things like prospecting for new clients or negotiating deals.”

The cloud-based platform gives owners and brokers access to deal-analysis tools, tenant health metrics, interactive site plans and more. Its creators came up with the idea after feeling frustrated with the inefficiencies and missing data sets in real estate, Romito says. He managed a 3 million-square-foot portfolio of office and retail space before teaming with Ryan Masiello (a former JLL broker) and Karl Baum (former head of a Goldman Sachs engineering team) to start VTS.

“Boston Properties was one of our first meetings,” Romito recalled. “I went in with a PowerPoint presentation, showed them what we were building and asked them what they thought. They said: ‘Guys, we have been dreaming about a platform like this. If you build it, we’ll buy it.’ They did, and it has been an unbelievable partnership.”

As a co-founder of Ravti, Alex Rangel brought to life an idea he first had while working as a sales engineer for an HVAC manufacturer: to transform the $100 billion commercial HVAC sector through a strategy similar to the one that fare aggregators and search engines in the travel industry use. In a little more than three years, Ravti has landed such clients as CBRE, Cushman & Wakefield, Regency Centers and Stiles Corp. Backers include Y Combinator (the incubator known for investing in the likes of Airbnb, Dropbox, Reddit and Twitch). “We don’t just pick up the phone and call American Airlines anymore; we go to Kayak or Expedia,” Rangel said. “These aren’t necessarily mind-blowing technology tools, but they do give you all of the prices of everyone transparently, so that you no longer have to make one call for each airline. Ravti essentially provides that Kayak or Expedia kind of experience for [the HVAC needs of] large owners and property managers.”

Ravti’s functionality includes online competitive bidding for HVAC projects and equipment, along with tools for tracking the condition and the budgets of HVAC units, portfoliowide. “It basically allows shopping center landlords to have a single platform to understand exactly what the current condition of the equipment is,” said Marc Elias, a Tampa, Fla.–based leasing agent with Regency Centers. “I use it all of the time in lease negotiations. It helps me understand if there are any maintenance issues in the past, and it gives me the current condition of the unit, age, tonnage, voltage — those kinds of things.” The expense of commercial HVAC equipment makes knowing its precise condition quite important in lease negotiations, Elias notes. Leasing agents also want to know whether particular units will be in compliance with the terms of the lease.

Before Ravti, leasing agents phoned or emailed property managers to request HVAC reports. Managers would then call contractors to check out the units and produce the reports. “It could take anywhere from 24 hours to two weeks for the contractor to get out to that site and send the report back to the leasing agent,” Rangel said. “Now leasing agents can click on their phones to make sure units are compliant and see the equipment history along with things like its age, size and last repair date.”

This means Elias and other leasing agents at Regency Centers, which has employed Ravti for two years, no longer need to scramble for HVAC contractors, or physically climb onto shopping center roofs to eyeball any HVAC equipment. This, in turn, can enable them to turn around lease outline drawings and tenant letters of intent more quickly. “Time turns into deals,” Elias said.

It is the promise of greater efficiency that makes this new wave of tech tools so exciting, Moss says. This applies not only to industry professionals, but also to customers, he says. Indeed, the potential to improve the customer experience is precisely why DDR has been working with Google Indoors–approved photographers to take 360-degree images inside its properties, he says. The goal is to more accurately geo-tag finer property details that can be misrepresented in Google Maps.

“Sometimes the automated geo-tags are not even close — they’ll incorrectly show a tenant in the middle of the parking lot,” Moss said. “We’re uploading our site plans and tenant lists, and so they are truly accurate. We then work with Google to geo-tag them. It makes a massive difference in the convenience to our customers, and the tenants appreciate this level of effort and attention to detail.”