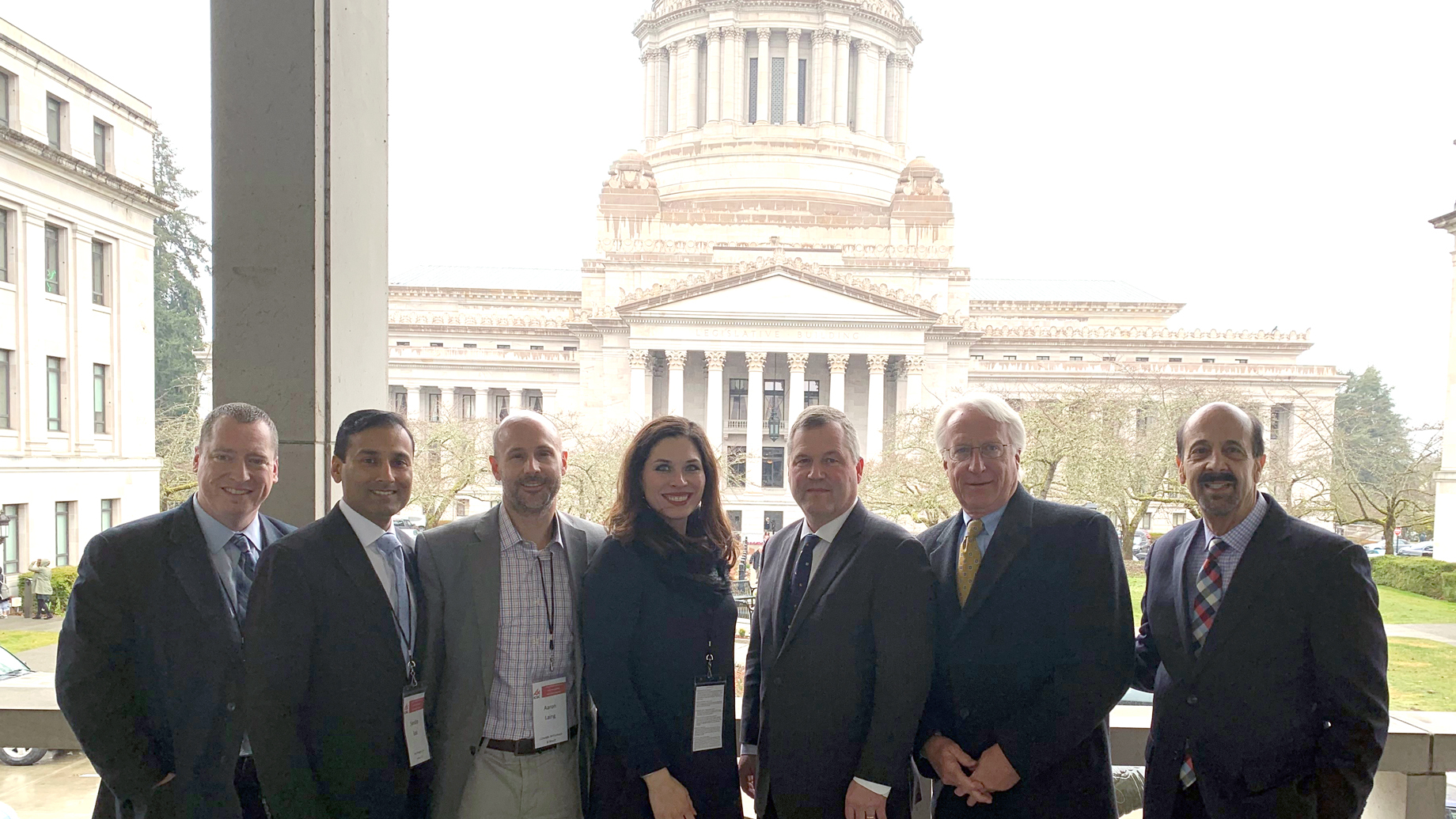

Members of the Washington State Government Relations Committee had their annual “Day at the State Capitol” on March 6. The group met with Representative JT Wilcox (House Minority Leader), Senator John Braun (Ranking Member Ways and Means), Representative Jake Fey (Chair House Transportation Committee), and the office of Representative Amy Walen, former Mayor of Kirkland, who was the Primary House Sponsor of HB 1890, also known as the Wayfair Bill.

The group joined the Washington Retail Associations Board of Directors for a luncheon that included a discussion with Governor Jay Inslee’s Chief of Staff Drew Shirk and Tax Advisor David Postman.

Two Wayfair bills (HB-1890/SB-5581) are close to being passed by both chambers of the legislature. In 2017, Washington passed an e-fairness bill requiring out-of-state online retailers to either collect and remit sales tax or to report the outstanding sales tax to the Department of Revenue. HB-1890/SB-5581 strips out the reporting requirements and establishes collect and remit thresholds similar to the South Dakota law ($100,000 in sales or over 200 transactions).

ICSC members also met with legislators to discuss two additional bills that would negatively impact the industry:

- Real Estate Excise Tax - The current proposal eliminates voter approval of any new real estate excise taxes;

- B & O Tax in Services and Capital Gains -The draft bill, among other things, imposes a new 9% tax on capital gains.

L to r: Chet Baldwin (Public Affairs Consulting, LLC), Sandip Soli (Real Property Law Group, PLLC), Aaron Laing (Schwabe, Williamson & Wyatt, P.C.), Alesha Shemwell (Bellevue Square Managers, Inc.), Representative JT Wilcox (Republican House Minority leader), Pete Jacobson (ICSC) and Mark Gjurasic (Public Affairs Consulting, LLC).