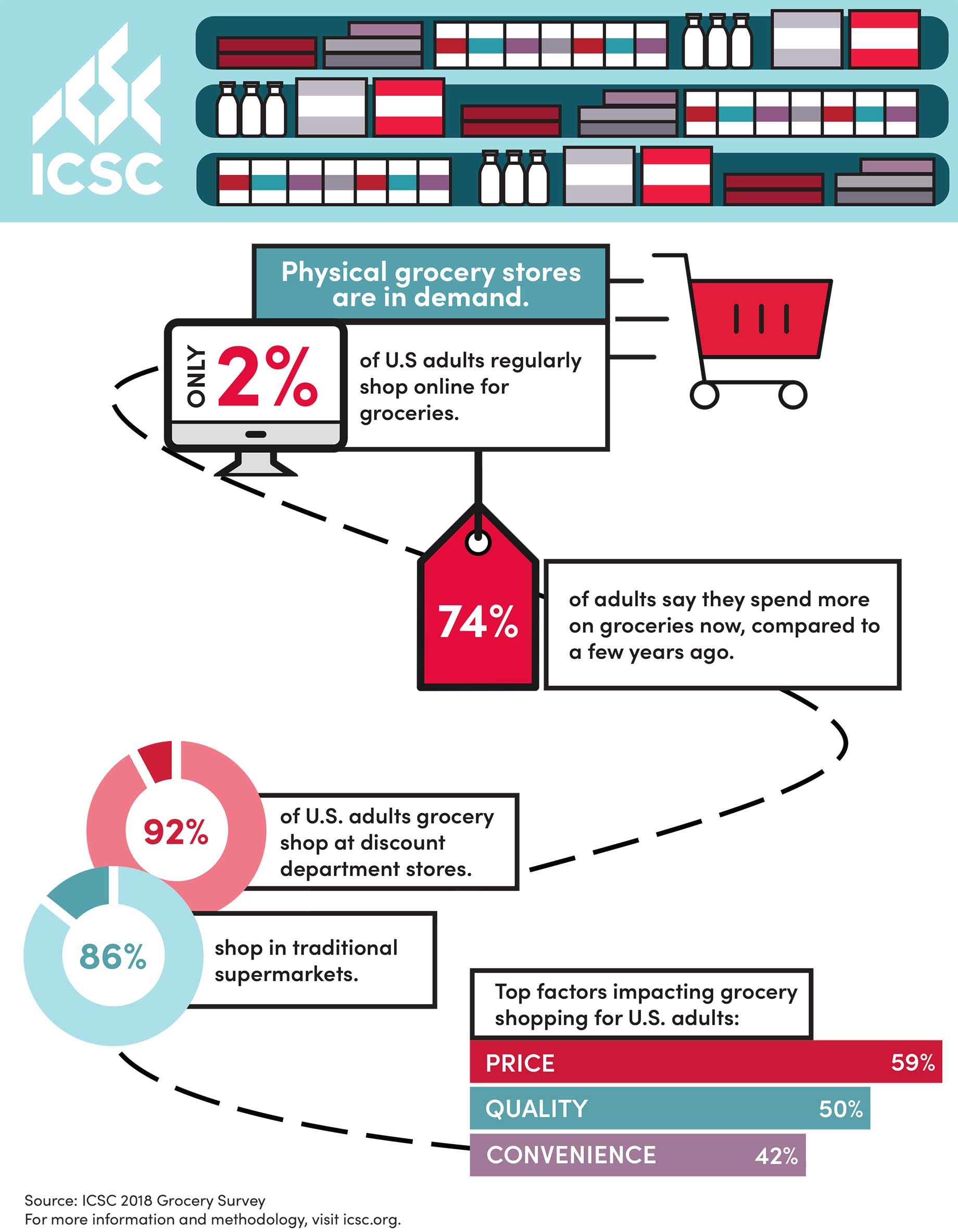

The vast majority of grocery consumers (92 percent) buy most of their groceries in physical stores, and most say they plan to keep doing that, according to a new ICSC report. Three-fifths of shoppers say they have never bought groceries online, but of those who do, only 2 percent say they do so routinely.

The Industry Insights report also shows the pre-eminence in the grocery market attained by discount department stores such as Walmart and Target. Today 92 percent of consumers say they do some of their grocery shopping at such stores.

“It will be interesting, when the results of the U.S. Census Bureau’s 2017 Economic Census are published, to see how discount department store grocery sales have grown since the last count, in 2012,” said Jean Lambert, vice president of ICSC Research.

Still, although discount department stores have raised their grocery profiles, regular grocery stores continue to do a huge amount of business. After all, the report points out, consumers shop at more than one store for their groceries: On average, they visit 5.4 different formats to make all their grocery purchases. According to the survey, traditional supermarkets are used by 86 percent of consumers; limited-assortment food stores (think Aldi, Save-a-Lot, Trader Joe’s) attract 67 percent, and warehouse clubs draw 62 percent.

Not surprisingly, then, there are roughly 38,500 supermarkets doing some $2 million in annual sales across this country. Traditional food-and-beverage stores — a U.S. Census Bureau category that excludes discount department stores but includes regular supermarkets, convenience stores, specialty food shops and liquor stores — represent one of the largest retail store categories, and they transacted $718 billion in sales last year. Only automobiles and automobile parts represent a bigger category in terms of annual sales.

“Traditional supermarkets remain tremendously important and do a lot of business,” said Lambert.

December’s ICSC New York Deal Making will feature a panel discussion titled Grocery Disruption, about the rapid evolution of grocery retailing. Panelists on this discussion, to be held Thursday, Dec. 6, will include executives from Aldi and Kroger. For details on the conference, click here.

Read more about the rapidly-changing grocery store landscape here.

By Edmund Mander

Director, Editor-In-Chief/SCT