Some $266 billion in private investor funds will be targeting commercial real estate, thus ensuring tight competition and high prices for prime properties next year. So says Emerging Trends in Real Estate, a report for which PwC and ULI reached out to about 2,000 industry professionals for their opinions and predictions.

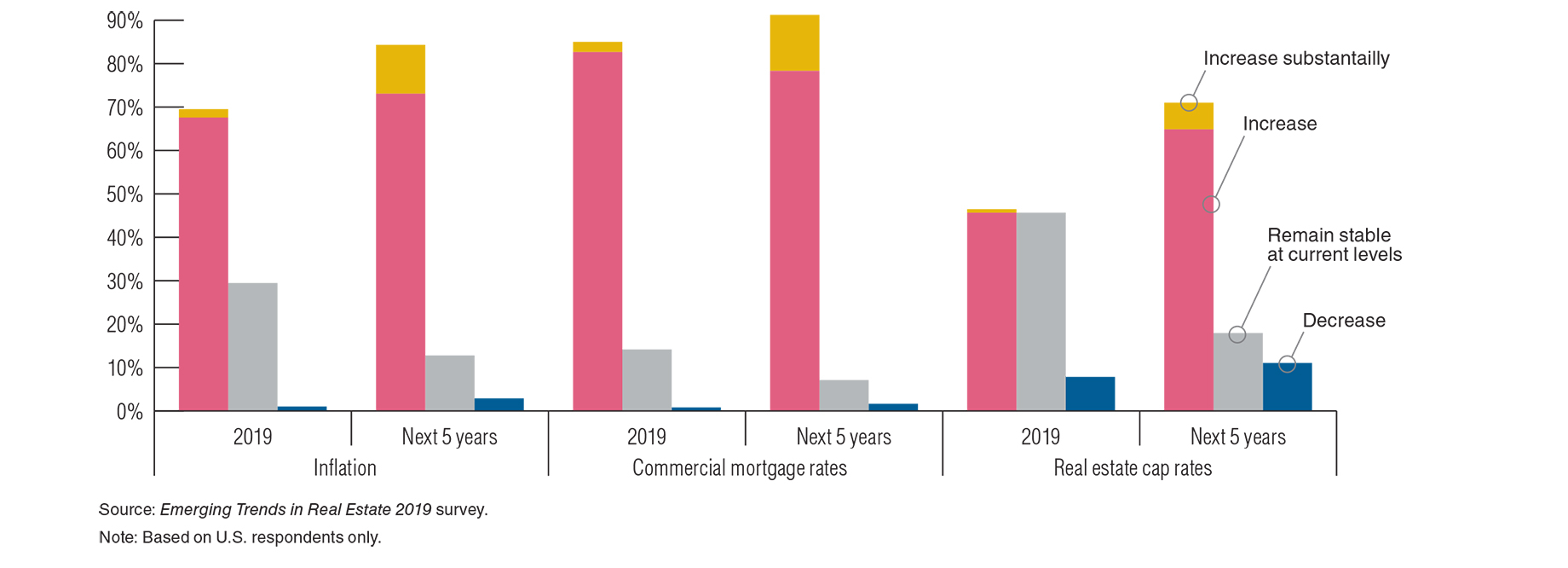

Anticipated inflation, interest and cap rates

Survey respondents see late-cycle conditions popping up, and many say they expect rising inflation to boost mortgage and capitalization rates in 2019 and over the five years following.

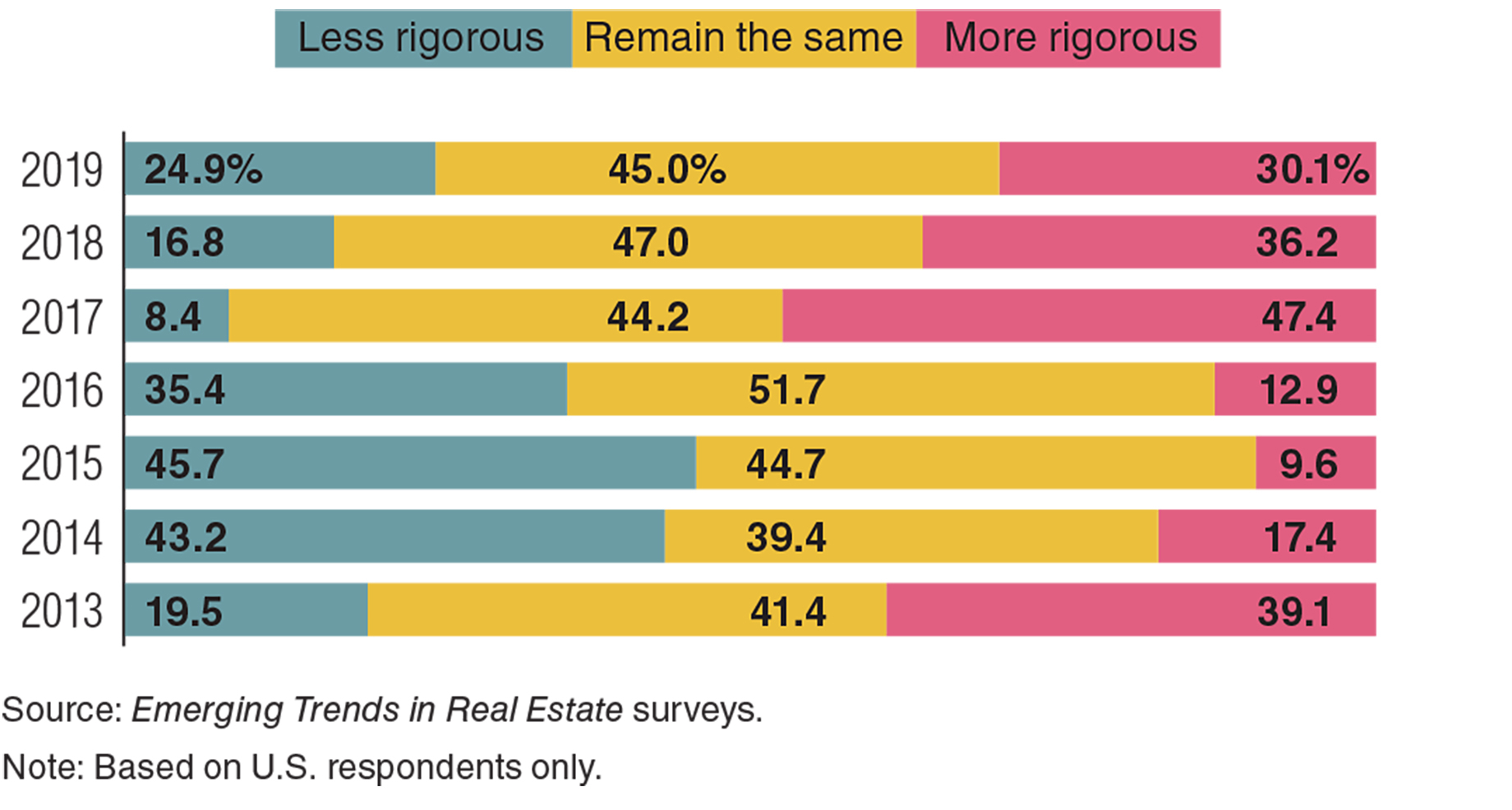

Debt-underwriting standards forecast for the U.S.

Heightened competition is tempting lenders to scrutinize loans less carefully, some are cautioning. The percentage of respondents who say they think the coming year will see more-rigorous lender analysis has dropped to 30 percent, from 36 percent a year ago — and from an exceptional 47 percent in the previous report. Meanwhile, the three-year trend among those who anticipate increased underwriting to favor borrowers has gone in the other direction, with 25 percent saying they expect a loosening of underwriting standards in 2019, versus 17 percent who thought so in the previous year's outlook, and a meager 8 percent for the year before that.

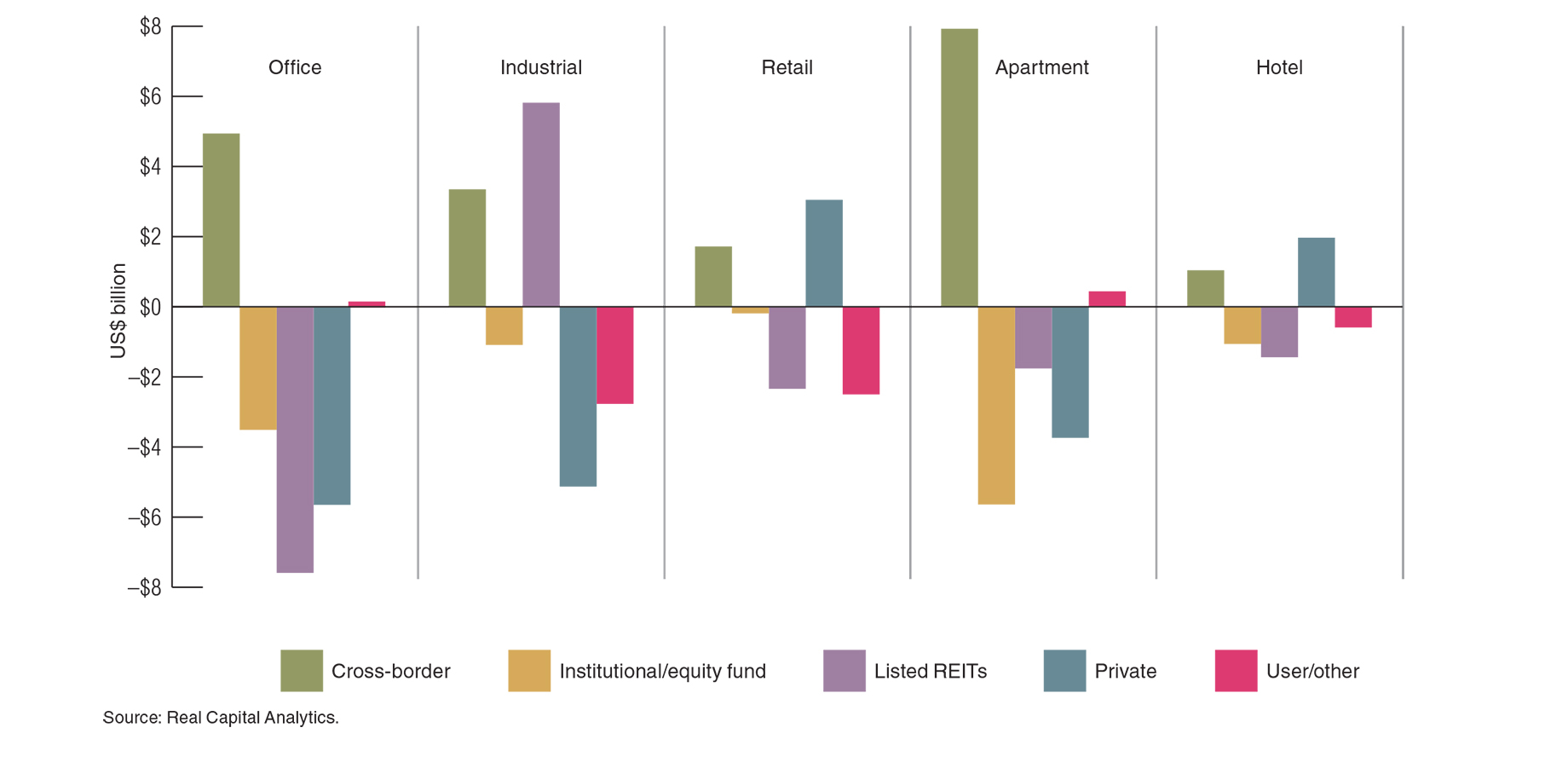

U.S. buyers and sellers: Net acquisitions, by source and property sector (July 1, 2017 to June 30, 2018)

Roughly 90 percent of survey respondents said they think the industry faces higher mortgage rates over the next five years, with 70 percent of those saying they anticipate that this will spark higher capitalization rates.

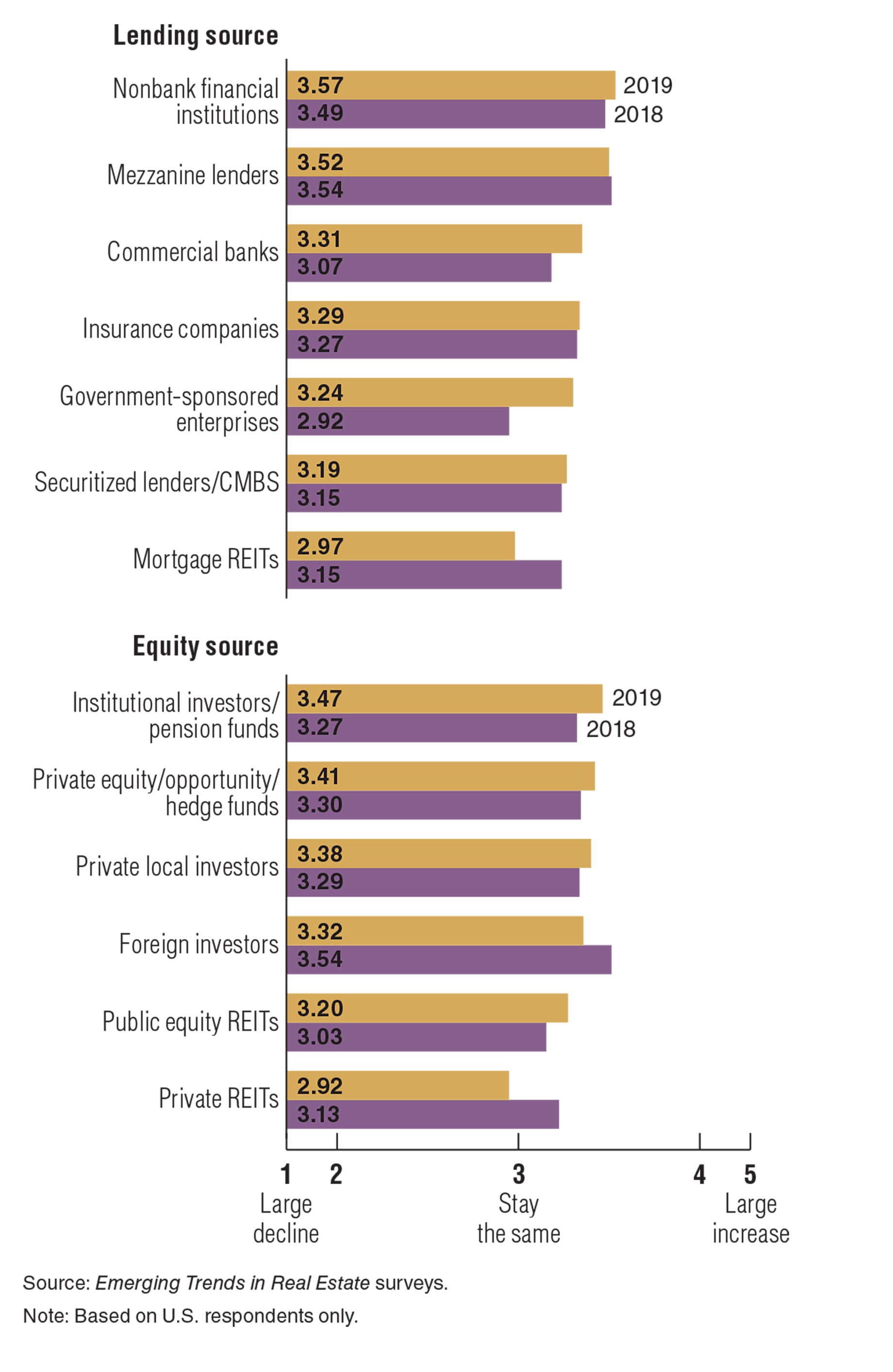

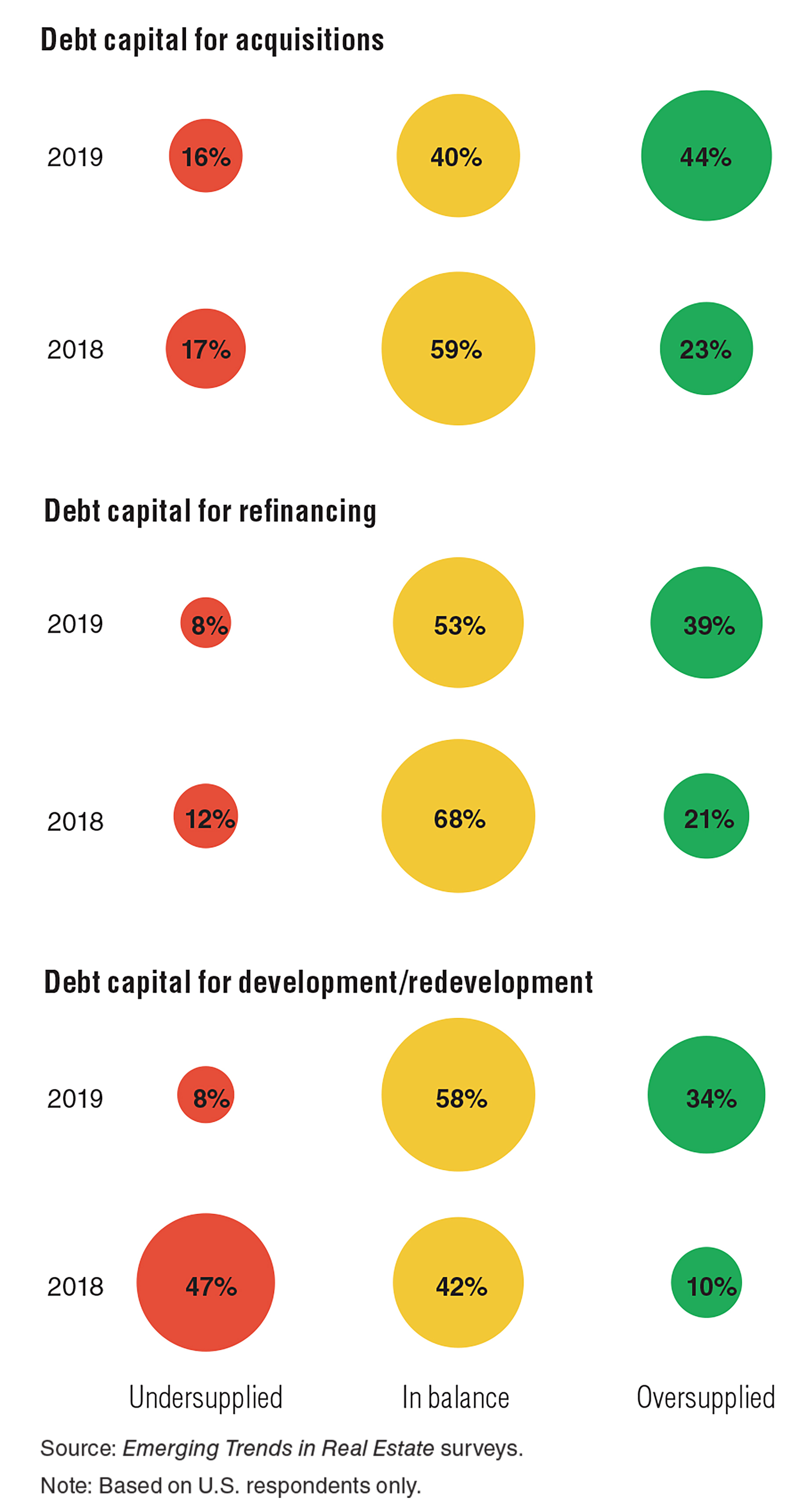

Availability of capital for real estate — 2019 vs. 2018

Improving conditions have encouraged banks, especially the bigger banks, to entertain larger loans for development projects and to expand the geography for construction lending. Underwriting standards, such as loan-to-cost ratios and maturities, however, have been holding steady.

Real estate capital market-balance forecast — 2019 vs. 2018

In terms of real estate net investment, respondents say that institutional investors are likely to remain a vital and reliably consistent factor. Though comparatively low returns and slow appreciation are marking the current picture, the institutions' longer investment horizon causes them to see prices as still rising — albeit modestly — and as remaining above the trend levels.

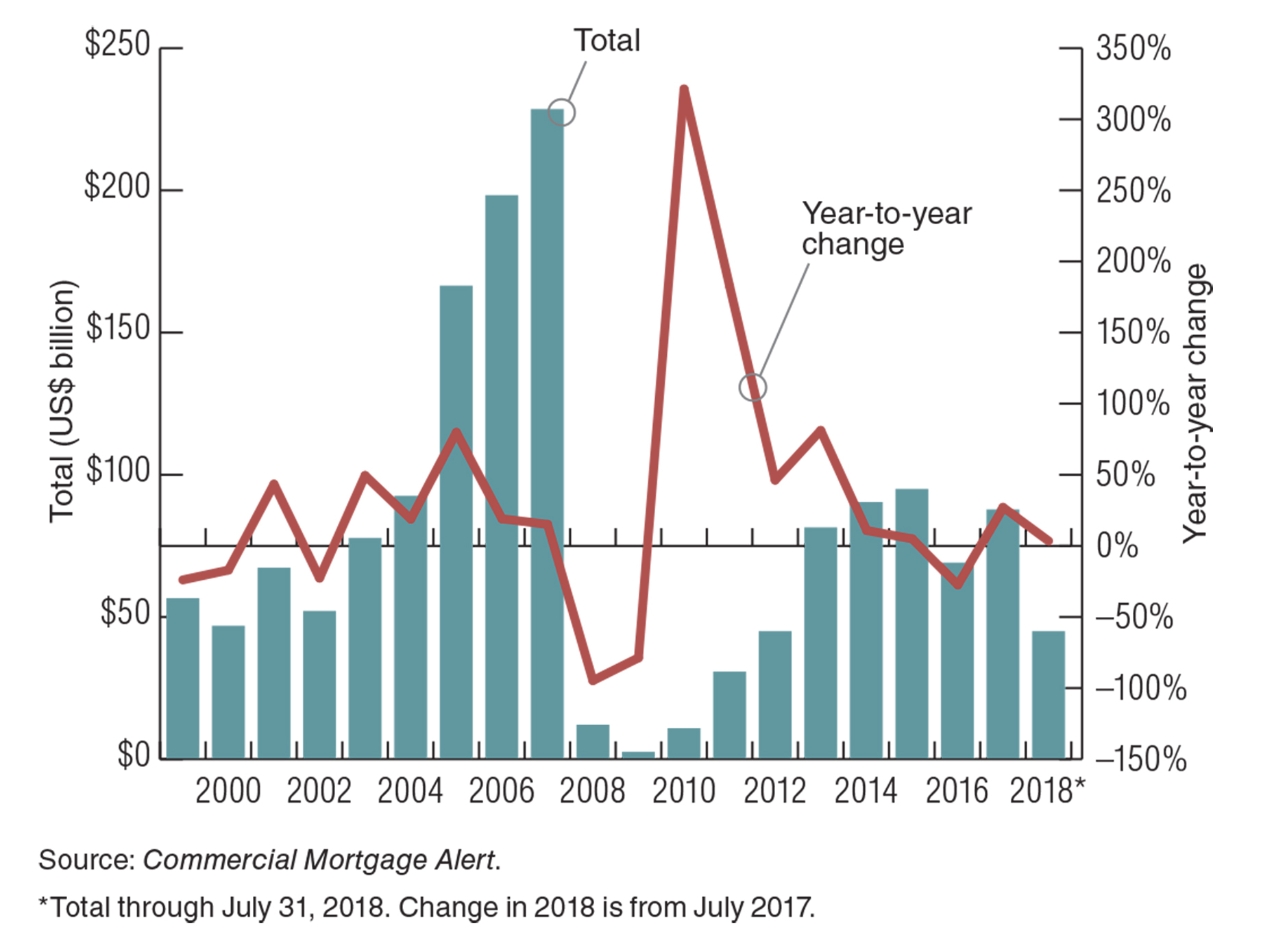

U.S. CMBS issuance

Overall volume of CMBS issuance is likely to be capped in the $80 billion to $100 billion range for the near future, survey respondents say. They expect that refinancing demand will decline as the so-called wall of maturities moves into the rearview mirror. The amount of CMBS maturing in 2018–2022 is paltry, owing to the Great Recession.

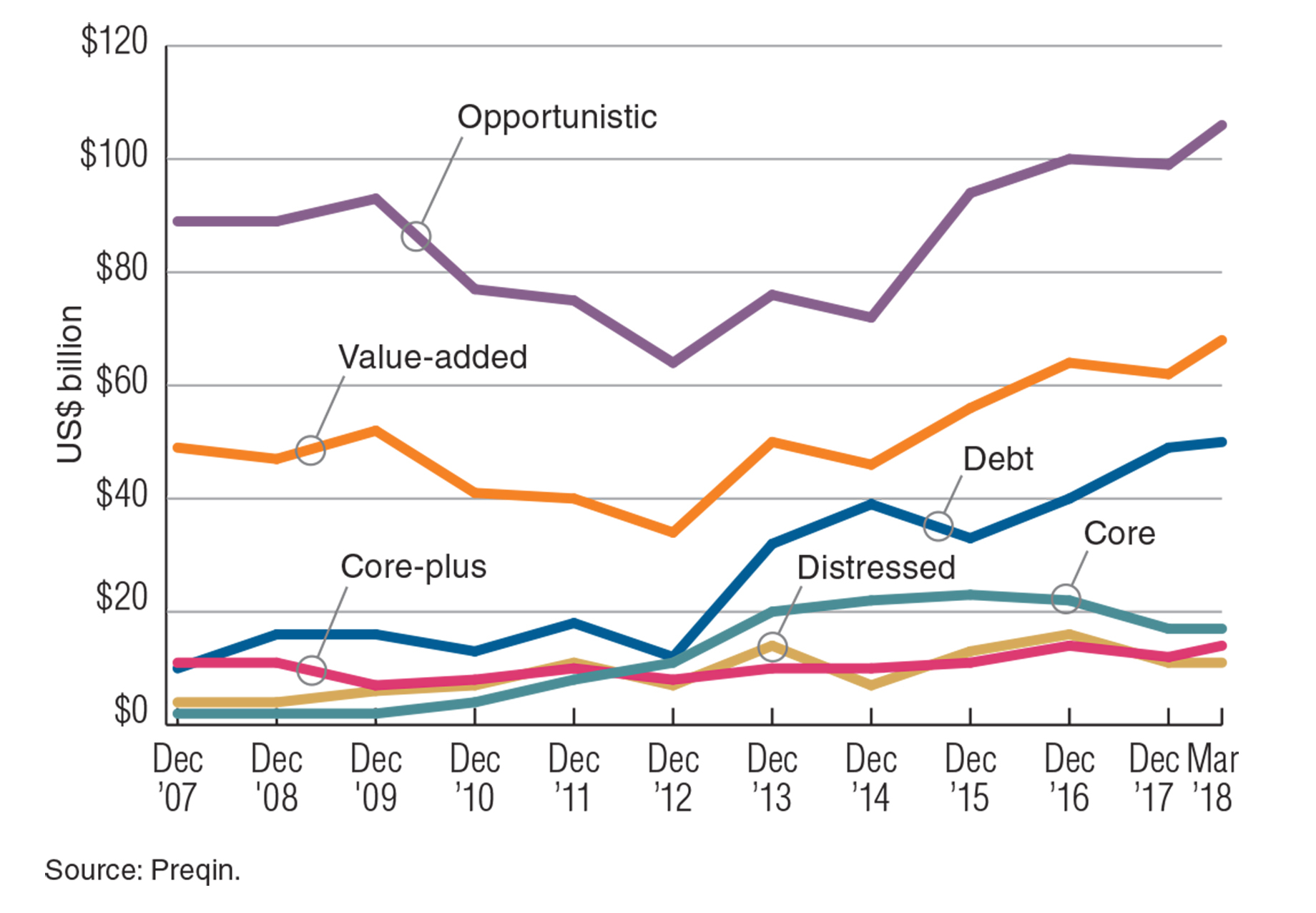

Closed-end private real estate dry powder — by strategy (December 2007–March 2018)

Private equity capital sources — including hedge and opportunity funds — are a growing category of real estate investment. The survey respondents say they expect capital availability from these sources to trail only the institutional investor and pension fund category. The “dry powder” of these funds sparks interest across the entire risk spectrum, but especially among value-add and opportunistic acquisitions, they say. This funding is already a potent capital source, with some $266 billion at the ready, and it promises advantages in flexibility and speed of execution once opportunity is identified. The head of a large valuation concern has termed this “an enormous wall of personal and family wealth” with the potential to protect pricing in the coming year.

By Brannon Boswell

Executive Editor, Commerce + Communities Today